are combined federal campaign donations tax deductible

For our supporters employed by the Federal Government the Fund is also registered in the Combined Federal Campaign as Diplomacy Matters-AFSA and its CFC number is 10646. This year the CFC celebrates its 60th anniversary.

Tax Deductible Charitable Donations Gifts That Give Back

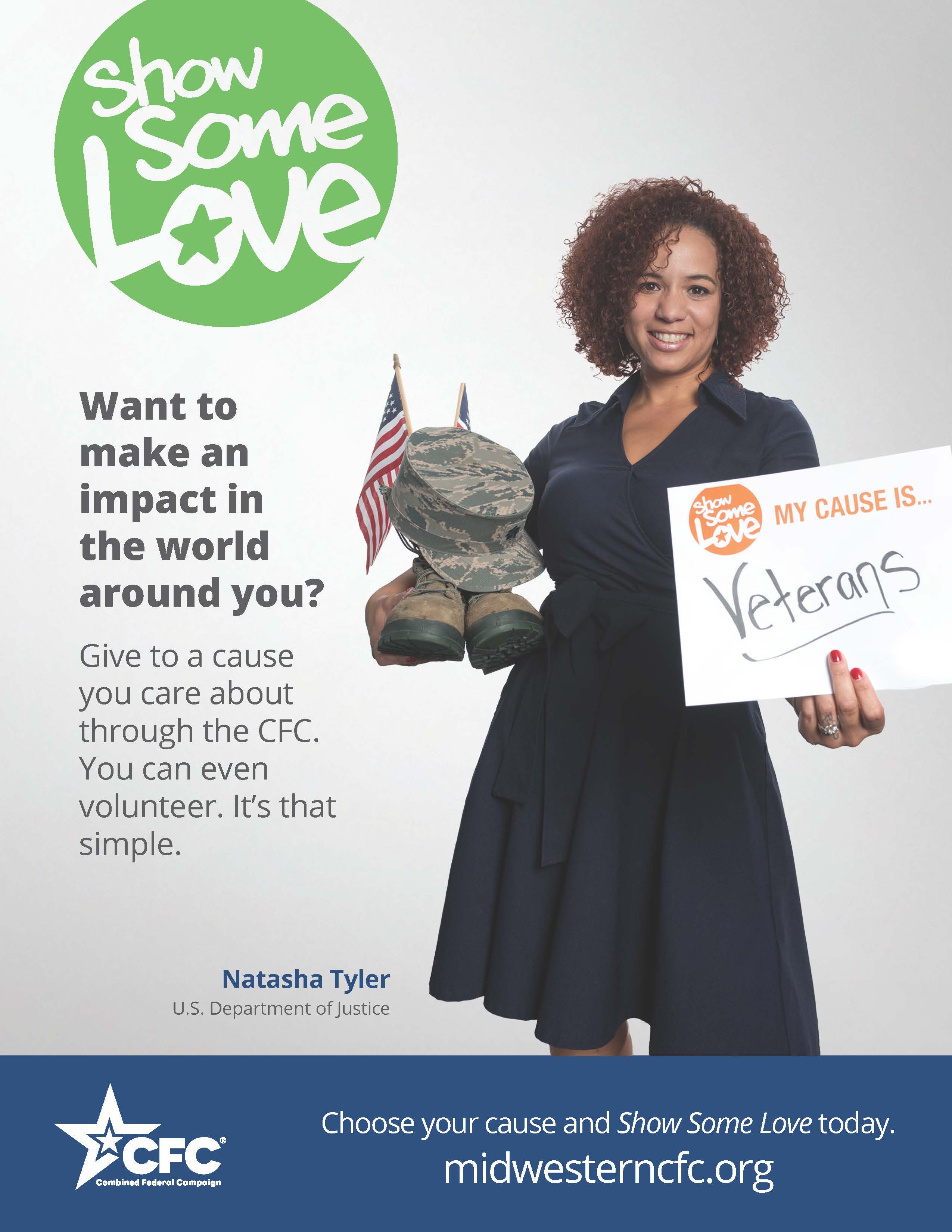

Overseen by the Office of Personnel Management OPM the Combined Federal Campaign is the official workplace giving campaign for federal employees and retirees.

. The Combined Federal Campaign CFC makes automatic deductions from your salary each pay period and sends your gift to your chosen organization or cause within the CFC donation list. Is this your nonprofit. Through Combined Federal Campaign.

Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method. Combined Federal Campaign Foundation Inc. Federal retirees are able to donate to their favorite charities through the Combined Federal Campaign CFC by making a one-time contribution or a recurring gift that is deducted from their retirement annuity.

Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC. Its easy to give online. Is a 501c3 organization with an IRS ruling year of 2009 and donations are tax-deductible.

This donation pays for the Capitol Hill legislative analysis and information center videos and. While tax deductible CFC deductions are not pre-tax. But does not involve any campaign contributions.

If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the property. This annual campaign for federal government civilian employees US Postal Service workers and members of the military has generated more than 280773 for ARRL programs since it first became an option for. AMVETS Charities is committed to using every dollar you donate through CFC to directly serve our fellow veterans.

Our Combined Federal Campaign number is 10519. Looking for even more reasons. All contributions made through the CFC are tax-deductible.

You may make a donation directly to the FAD by clicking here. Yes you can deduct them as a Charitable Donation if you file Schedule A. Donors who are eligible to itemize charitable contributions on income tax returns may include contributions made through the CFC.

Since its inception the CFC has raised more than 85 billion for charities and people in need. Join the 2021 Combined Federal Campaign CFC and donate to MACV today. Federal law does not allow for charitable donations through payroll deduction CFC or any other.

Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. Of the 50000 charities that participate in the CFC only about 1500 the. If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax.

Retirees may donate through the online donor pledging system or through retiree paper pledge forms. Federal law does not allow for charitable donations through payroll deduction CFC or any other payroll deduction program to be done pre-tax. Make all of your charitable donations and pledge volunteer hours in one place.

Are Combined Federal Campaign donations tax deductible. While inside the software and working on your return type charitable donation in the Search at the top of the screen you may see a magnifying glass there. For nearly 20 years the US Office of Personnel Management has designated the ARRL participant 10099 to participate in the Combined Federal Campaign.

The Combined Federal Campaign is happening now until January 15 2022 allowing personnel and retirees to pledge monetary support and volunteer time to approved charities. Can I deduct my contributions to the Combined Federal Campaign CFC. Provides ACUF with unrestricted funds.

Nothing will be deducted for our administrative or marketing costs which means veterans will receive 100 of the proceeds. While tax deductible CFC deductions are not pre-tax. Tax-deductible giving New legislation in 2020 allows taxpayers to deduct 300 600 for married couples even when taking the standard deduction.

If a donor makes a CFC payroll deduction are those contributions taken pre-tax or after-tax. And since all participating recipients are 501c3 organizations you will enjoy a combined federal campaign tax deduction. Click here to access our most recently available annual financial statements and 990 tax filings.

Easy to renew. Give for Collective Impact. Donors should contact a tax advisor for more information.

How to get to the area to enter your donations. When we give together it means bigger checks for charities. If you do itemize deductions on your tax return and want to take a tax deduction for this donation choose NumbersUSA Education Research Foundation 501c3.

YOUR CFC DONATION TO ACUF IS ALSO. There will be a. Combined Federal Campaign CFC Are you a federal employee or retiree.

If interested in making a stock donation please call MACV headquarters at 651-291-8756 for more information. Secure via the online giving platform. Federal retirees and contractors working in a federal facility can also make a one-time deduction.

While tax deductible CFC deductions are not pre-tax. All donations to the FAD are tax-deductible. We appreciate your support.

Access the Nonprofit Portal to submit data and download your rating toolkit.

Tax Deductible Donations These Are The Conditions

Four Ways To Maximize Charitable Giving Impact In 2021 Schwab Charitable Donor Advised Fund Schwab Charitable

Federal Retiree Giving Combined Federal Campaign Of Southern California

Federal And California Political Donation Limitations Seiler Llp

Tax Deductible Donations Can You Write Off Charitable Donations

How Much Should You Donate To Charity District Capital

What Is The Combined Federal Campaign Article The United States Army

Combined Federal Campaign National Association Of Letter Carriers Afl Cio

How Did The Tcja Affect Incentives For Charitable Giving Tax Policy Center

Four Ways To Maximize Charitable Giving Impact In 2021 Schwab Charitable Donor Advised Fund Schwab Charitable

13 Tips For Making Your Charitable Donation Tax Deductible In 2017

Complete Guide To Donation Receipts For Nonprofits

Charitable Deductions On Your Tax Return Cash And Gifts

Midwestern Cfc Is In Full Gear Donate Today Article The United States Army

List Of 6 Arizona Tax Credits Christian Family Care

Tax Deductible Donations Can You Write Off Charitable Donations

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace